Prediksi Nilai Cryptocurrency Dengan Metode Bi-LSTM dan LSTM

Abstract

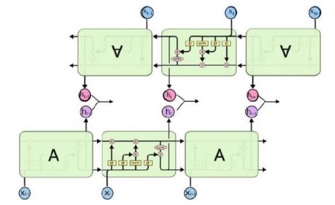

The current rapid development of technology can facilitate all human activities, so that all aspects cannot be separated from technology, including the financial sector. With the development of technology, it is also accompanied by the introduction of various investment instruments. Every time you make an investment, of course there will always be various risks that come with it, including investing in cryptocurrencies, one of which is bitcoin. Unlike conventional currencies, bitcoin is not decentralized so that its price development is not under the supervision or control of any party, where as conventional money there is a certain institution that oversees and controls its movements. This causes the price of the exchange rate of bitcoin to be inconsistent or unstable. With the prediction method, bitcoin users can determine the right time to carry out transactions. This study aims to predict bitcoin prices using the LSTM and Bi-LSTM methods. Based on the research results, the best prediction results were obtained using the Bi-LSTM method with an RMSE of 1482.73 whereas with LSTM it produces an RMSE of 1768.69 so that it can be concluded from an accuracy perspective that Bi-LSTM gives more accurate results but with Bi-LSTM it requires more resources.

Downloads

References

[2] Putri, R.N.M.H., Primasari, N.S. and Khusnah, H. ‘Return Analisis Teknikal Moving Average, Bollinger Band, dan Relative Strength Index pada Cryptocurrency’, Jurnal Ilmiah Akuntansi dan Keuangan, 11(1), pp. 21–30, 2022.

[3] Fatah, H. and Subekti, A. ‘Prediksi Harga Cryptocurrency Dengan Metode K-Nearest Neighbours’, Jurnal Pilar Nusa Mandiri, 14(2), p. 137. doi:10.33480/pilar.v14i2.894, 2018.

[4] Yukhlifa, R.F. PERBANDINGAN PREDIKSI HARGA CRYPTOCURRENCY DENGAN MODEL ARIMA DAN LSTM. Universitas Internasional Semen Indonesia,2021.

[5] Setiawan, R., Parlika, R. and Mumpuni, R. ‘Rancang Bangun Bot Auto Trade Cryptocurrency Berbasis Web’, Jurnal Informatika dan Sistem Informasi (JIFoSI), 1(2), pp. 294–301. Available at: http://jifosi.upnjatim.ac.id/index.php/jifosi/article/view/102, 2020

[6] Arifan Juanda, R., Jondri and Atiqi Rohmawati, A. ‘Prediksi Harga Bitcoin Dengan Menggunakan Recurrent Neural Network’, eProceedings of Engineering, 5(2), pp. 3682–3690, 2018.

[7] Wiranda, L. and Sadikin, M. ‘Penerapan Long Short Term Memory Pada Data Time Series Untuk Memprediksi Penjualan Produk Pt. Metiska Farma’, Jurnal Nasional Pendidikan Teknik Informatika (JANAPATI), 8(3), pp. 184–196, 2019.

[8] Selvin, S. et al. ‘Stock price prediction using LSTM, RNN and CNN-sliding window model’, 2017 International Conference on Advances in Computing, Communications and Informatics, ICACCI 2017, 2017-Janua, pp. 1643–1647. doi:10.1109/ICACCI.2017.8126078, 2017.

[9] Afrianto, N., Fudholi, D.H. and Rani, S. ‘Prediksi Harga Saham Menggunakan BiLSTM dengan Faktor Sentimen Publik’, Jurnal RESTI (Rekayasa Sistem dan Teknologi Informasi), 6(1), pp. 41–46. doi:10.29207/resti.v6i1.3676, 2022.

[10] Harwick, Cameron. ‘Cryptocurrency and the Problem of Intermediation’. The Independent Review, v. 20, n. 4, Spring 2016, ISSN 1086–1653, Copyright © 2016, pp. 569–588.

[11] Houben & Snyers. ‘Cryptocurrencies and blockchain’. Policy Department for Economic, Scientific and Quality of Life Policies. Authors: Prof. Dr. Robby HOUBEN, Alexander SNYERS. Directorate-General for Internal Policies PE 619.024 - July 2018

[12] Hassani, H. and Huang, X. and Silva, E.S. ‘BigCrypto: Big Data, Blockchain and Cryptocurrency’. Big Data and Cognitive Computing, 2 (34). ISSN 2504-2289, 2018.

[13] Rahardian, R.L. and Sudarma, M. ‘Application of Neural Network Overview In Data Mining’, International Journal of Engineering and Emerging Technology, 2(1), p. 94. doi:10.24843/ijeet.2017.v02.i01.p19, 2017.

[14] Made Doddy, Made Sudarma, Nyoman Pramaita, I Made Oka Widyantara; “Filtering Outlier Data Using Box Whisker Plot Method For Fuzzy Time Series Rainfall Forecasting.” IEEE Access, no. 978-1-5386-6163-5/18/$31.00: 2–5. 4th International Conference on Wireless and Telematics (ICWT). doi:10.1109/icwt.2018.8527734, 2018.

[15] Chen, S. and Zhou, C. ‘Stock Prediction Based on Genetic Algorithm Feature Selection and Long Short-Term Memory Neural Network’, IEEE Access, 9, pp. 9066–9072. doi:10.1109/ACCESS.2020.3047109, 2021.

[16] Thai-Ha Le, Anh Tu Chuc, Farhad Taghizadeh-Hesary, Financial inclusion and its impact on financial efficiency and sustainability: Empirical evidence from Asia, Borsa Istanbul Review, Volume 19, Issue 4, Pages 310-322, ISSN 2214-8450, 2019. https://doi.org/10.1016/j.bir.2019.07.002

[17] Ertugrul, A. M., & Karagoz, P. Movie Genre Classification from Plot Summaries Using Bidirectional LSTM. Proceedings - 12th IEEE International Conference on Semantic Computing, ICSC 2018, 2018-Janua, 248–251. https://doi.org/10.1109/ICSC.2018.00043

[18] Ratniasih, Ni Luh, Made Sudarma, and Nyoman Gunantara. “Penerapan Text Mining Dalam Spam Filtering Untuk Aplikasi Chat.” Majalah Ilmiah Teknologi Elektro 16 (3): 13, 2017. https://doi.org/10.24843/mite.2017.v16i03p03.

[19] Hodson, T. O.: Root-mean-square error (RMSE) or mean absolute error (MAE): when to use them or not, Geosci. Model Dev., 15, 5481–5487, https://doi.org/10.5194/gmd-15-5481-2022 , 2022.

[20] Chicco D, Warrens MJ, Jurman G. The coefficient of determination R-squared is more informative than SMAPE, MAE, MAPE, MSE and RMSE in regression analysis evaluation. PeerJ Comput Sci. 2021 Jul 5;7:e623. doi:10.7717/peerj-cs.623. PMID: 34307865; PMCID: PMC8279135.

[21] Ozili, Peterson K. The acceptable R-square in empirical modelling for social science research. Munich Personal RePEc Archive. Online at https://mpra.ub.uni-muenchen.de/115769/MPRA Paper No. 115769, posted 26 Dec 2022 14:32 UTC

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

This work is licensed under a Creative Commons Attribution 4.0 International License